Bad Pennies

by Carter Scholz

TESTIMONY of Deputy Director RICHARD SNOW

Thank you, sir. It’s a pleasure to be here again.

I first met Mister Kak in, wait, is, is the date classified—? Let’s just say in the nineteen eighties. He came to my attention, to the Agency’s attention, through a series of memos from the station chief in Vinograd, where Mister Kak lived at the time.

The Vinograd regime was unresponsive to diplomacy. The Agency wanted to inject one billion dollars in colorable local currency into the black market, thus destabilizing the, yes Senator?

Colorable. We don’t use the word counterfeit.

Well, Senator, there is ample precedent. I mean, the Brits did it to the Soviets, the Germans did it to the Brits, the Paks did it to the Indians. In Vietnam the United States issued what we call parody currency, solely as a propaganda front.

The actual manufacture of the currency? I can’t discuss that.

Okay. We set up a firm in Vinograd, called Polemonium Assets, with Mister Kak in charge. He made loans, he procured infrastructure from local businessmen, et cetera. But despite a massive injection of really very well made banknotes, the official economy stayed flat. There was no price inflation, no rush to redeem old bonds, no pressure on the central bank or the government. Because the General ordered the central bank: As long as no one withdraws, there’s no problem.

Okay, so with the official currency sequestered, our notes were traded on the street. And there was a general upturn. Goods and services returned to Vinograd. Houses were painted, flowers appeared in windowboxes. There was a, wait, sorry, here it is, a wary cheerfulness, as one of our assets put it. People were happier. The General took note of this, and he took credit. He was photographed in a street market eating an orange.

What? No sir, I believe it was simply that the General thought the image resonated with a populace long deprived of oranges, and he wished to associate himself with the, the sudden orange, so to speak.

Okay, so contrary to our intents, there was no inflation, no pressure on the government. Then Mister Kak suggested to the central bank that they establish a secondary market in our colorables. Brilliant idea. Pretty soon they were trading above the genuines. With its newfound liquidity the central bank issued a series of high yield bonds, and foreign investors snapped them up. Mister Kak’s firm saw large profits.

Yes, I mean no. Mister Kak’s accounting practices in this period weren’t quite up to American standards. I don’t think we can determine now exactly where every penny went.

Well, Senator, it seems to me there’s a double standard here. I mean, first of all yes it’s a striking irony, if you want to put it that way, that Polemonium Assets actually propped up the government we meant to overthrow but after all Senator, by the time the central bank defaulted it was Citibank not Polemonium propping them up, and you’re not going after Citibank, are you?

In the first six months alone Mister Kak’s company created a half billion dollars in new wealth not to mention, yes Senator?

The cost? You mean of producing the currency or, of, of the whole project?

Around three billion dollars.

Yes but Senator, we started with counterfeits, and the wealth Mister Kak created was real. He took a fictitious wealth and he, he, ah, bonified it. That is entrepreneurism, Senator. I don’t think you want to dis, uh, disparage that.

Okay, our original goal was to bring down the economy, yes. But that was only a tactic in the service of regime change. In the long run we achieved our goal, because the General closed the central bank and fled with the assets.

The bank’s assets then were about four billion dollars. At that juncture Mister Kak closed the doors of his company as well.

Well, sir, that is a matter for the international banking community to resolve. We did not permit the General to skip town, as you put it, nor did we have orders to stop him. If the European and American banks that invested have a problem, I think they can solve it in the usual way.

Bailout isn’t the word I’d use. To me this is a matter of protecting an investment in democracy.

Democracy, sir, is when people get to choose a government that gives them freedom in the marketplace. But to return to the other gentleman’s question, banks make loans all the time, all over the world, why is this different? There’s risk in any enterprise—

Senator, I disagree.

That is a regrettable choice of words, Senator.

No sir, Mister Kak was not and is not an Agency asset, certainly not, he is, he was always, that is, he was an independent contractor. He never drew a salary.

No sir, the General was never an asset. I don’t know where you got—

That would fall under protecting sources and methods.

On behalf of the former Secretary, I object. There was no indictment.

Yes, thank you. I would, I would like to get back on track if the gentleman will let me. At that point, after the collapse of the government, Polemonium Assets was acquired by a startup called Peregrine Capital in McLean, Virginia.

I’m pleased to hear your concern and the committee’s concern on this issue. Okay, briefly. The Agency does have a vital ongoing interest in the sort of situations that may threaten the United States. We would like to be in a position to encourage what you might call preventative diplomatic economic efforts. Mister Kak proved an acute observer and a nimble mover in this arena. That was our purpose in helping Peregrine Capital set up shop in the United States. Peregrine provided us insight and clarity concerning world market forces. That’s all.

Yes, Mister Kak took on partners at that time.

Yes, the former Secretary was one.

I guess you’d call it a hedge fund. The prospectus says, wait, Peregrine Capital seeks out arbitrage opportunities in international currency markets.

Peregrine did very well in its first two years, posting return to investors of about forty percent per annum. This gave Peregrine very good standing with creditor banks. They leveraged about ten billion dollars of invested capital into positions of about a half trillion dollars.

Yes sir, trillion.

May I continue? It wasn’t all roses. When the Thai baht collapsed, Peregrine lost quite a lot. A lot of investors did. Japanese banks were perhaps the hardest hit.

Mister Chairman, thank you for pointing that out. It’s as you say a sort of silver lining that more favorable US trade balances with Asia resulted.

What? Senator, I don’t know where you got that but—

Well, Financial Times or not I think—manipulating the baht—sweeping in with his associates to buy valuable state assets at knockdown prices—I mean, that’s not a fair assessment. That doesn’t square with the facts on the ground. The market is what it is. You can accept that or you can try to turn back the tide.

Yes, thank you Mister Chairman, I’m sure we don’t want to, to get into the macro, I mean the micro, I mean I’m not a financial expert. My concern is with the national security implications.

Next summer Russia defaulted on its international loans, leading to more losses for Peregrine. At that point the Federal Reserve became worried about the effect on world markets if the hedge fund failed, so the Fed arranged a recapitalization of Peregrine through a consortium of private banks. Peregrine’s holdings at that point were about one point five trillion dollars. Their capital was down to about three billion. That’s, what is that, fifty to one?

Okay, five hundred to one leverage.

Moral hazard? I don’t understand the term.

Sir, Alan Greenspan said it was not a bailout. Can we move on?

Part of the recap deal was that Mister Kak stay on as manager for a year. At the same time, Mister Kak established the Palladium Group. It, wait, the prospectus says it offers high level strategic advisory and advocacy services to international clients and to government agencies.

No, the Agency has no connection with Palladium.

I’m not familiar with those names.

It is possible that some retired Agency personnel are employed by Palladium. We don’t tell our retirees what to do.

Sir? I don’t know what you’re inferring.

Again Senator, there were no convictions in that matter, and I wonder why you keep digging up ancient history.

Okay, that, yes that recent operation took a lot of, of press, didn’t it. Yes, by all means, let’s talk about that operation. That operation had both military benefits and security benefits and economic benefits. First, the contraband fissile material was interdicted at the border. Second, the quantity was relatively small. Third, it proves that market forces treat this kind of contraband material the same as any other material. To me that says the operation was a success. It creates an opportunity for us. As a result of it, we have a new tool for fighting terrorism.

Yes, exactly, Mister Chairman. A sting. First we sell it to them and then we take it back. This creates a market for the material which drives up the price, which forces terror groups to spend themselves into a downward spiral. Since we’re a market maker in this material, other players will come to us and that also gives us a chance to repatriate some of the contraband material that’s got out there over the years.

Uh, how much, how much contraband material is out there—isn’t that classified?

No? Okay, if you insist, about twelve thousand kilograms. That we know of. More or less.

A, a weapon? You mean a device. You could make a nuclear device from, ah, about six kilograms of this material.

I think that would make twenty? Two hundred? No, okay, two thousand devices. More or less.

Mister Chairman, again, I want to come back and say I’m pleased to hear your concern and the committee’s concern on this issue. I have to go and refresh myself on this, but I don’t think—I think that if it’s a trade issue—I mean, is it fair trade practice to take in fissile material and introduce it to the market without having any cost associated? We’ll have to study that, sir.

No, Senator. I don’t think this is a matter of where Mister Kak is or isn’t or what he has or hasn’t done. It’s more about the roles we have established for the kinds of players that best fill them.

You’ve already heard testimony from the Vice President and from the gentlemen at Treasury, Justice, and State on how valuable Mister Kak has been to them. In closing let me say that he is a patriot twice over. He has served and sacrificed for his homeland, and for his adopted country. He has served on advisory panels, he has testified before Congress on several occasions, and there should be no further delay in confirming his appointment as our next Secretary of Homeland Security.

Yes, sir. Nice to see you too. Thank you. You make me blush.

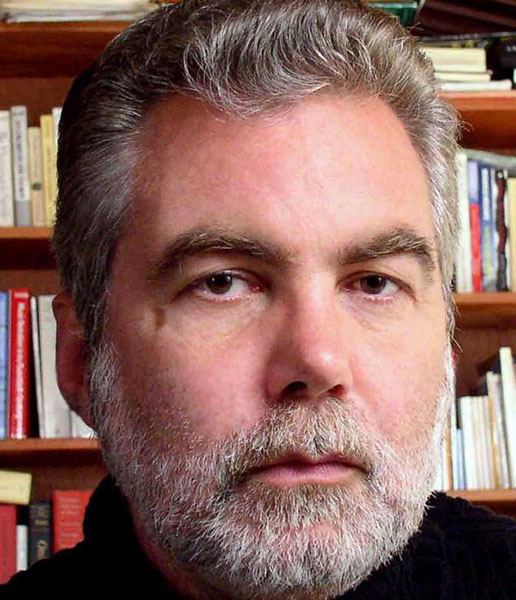

About the Author

Carter Scholz lives in California. He is the author of Palimpsests (with Glenn Harcourt), Kafka Americana (with Jonathan Lethem), Radiance, and The Amount to Carry.

Please mention the author or this piece's name in your comment.